What is Pay-per-Use Financing?

With Pay-per-Use financing, you pay for the actual usage of equipment. There are no hidden costs or penalties if it is used less than planned. This increases flexibility in managing cash flow and avoids high fixed payments that can be difficult to manage when customer demand and revenues are low. The key difference between traditional leasing and Pay-per-Use: with Pay-per-Use, you only pay for actual usage. In accounting terms, you transform CAPEX into OPEX and match costs to revenues.

Pay-per-Use Financing

- Flexible repayment depending on the actual utilisation of the equipment

- Less usage leads to a lower repayment rate and vice-versa

Traditional Financing

- Rigid payment rate independent of the actual utilisation of the equipment

- Equipment operators must pay every month the same repayment rate even if there’s less use

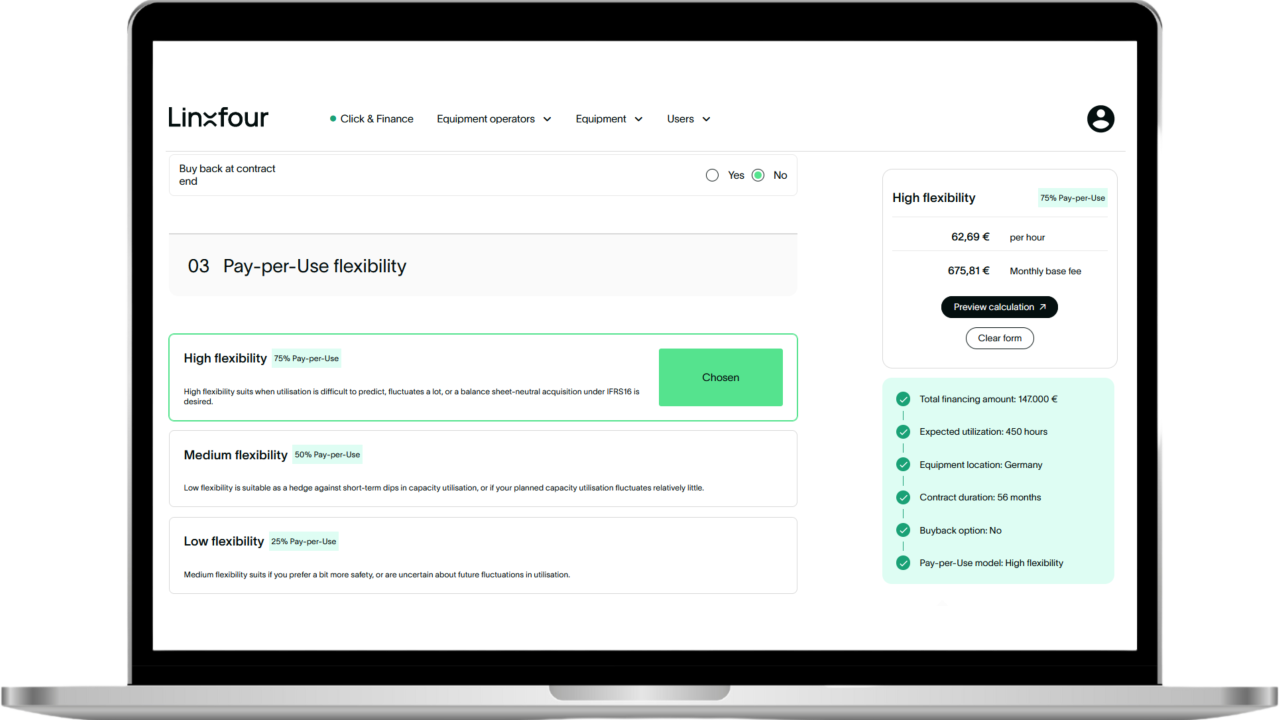

Instant online financing with Click & Finance calculator

Linxfour is dedicated to improving equipment finance with efficient processes.

The Click & Finance calculator assists equipment manufacturers and brokers in easily generating customized Pay-per-Use financing quotes. This includes conducting credit checks, with just a few clicks. Available anytime, anywhere.

How does Linxfour approach refinancing?

A unique aspect of Linxfour’s financing solution is that we underwrite true utilisation risk such that equipment manufacturers avoid any utilization or credit risk. This is possible through our AI data driven risk management and an array of strategic refinancing partnerships, including setting up the Linxfour Equipment Fund.

Empowering Technology for the Future of Equipment Financing